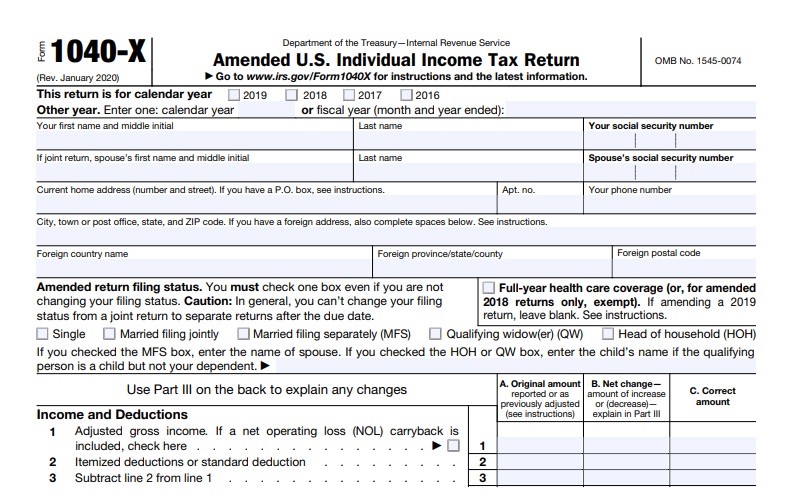

On May 28, 2020, IRS announced the addition of Form 1040-X – ‘Amended U.S. Individual Tax Return’ to the list of forms available for electronic filing starting this summer. Making the 1040-X an electronically filed form has been a goal of the IRS for a number of years as about 3 million Forms 1040-X are filed by taxpayers each year. IRS Commissioner Chuck Rettig stated the following while making the announcement:

This new process is a major milestone for the IRS, and it follows hard work by people across the agency, E-filing has been one of the great success stories of the IRS, and more than 90 percent of taxpayers use it routinely. But the big hurdle that’s been remaining for years is to convert amended returns into this electronic process. Our teams have worked diligently to overcome the unique challenges related to the 1040-X, and we look forward to offering this new service this summer.

Electronic filing of Form 1040-X will reduce processing time and errors associated with the manual input of these forms. Further, the new electronic filing option will enable the IRS customer service to better answer taxpayers’ questions as the customer service will have access to complete and accurate data in an easily readable format.

When the electronic filing option becomes available, it will apply to tax years 2019 and future tax years. Only, Forms 1040 and 1040-SR can be amended electronically.

This is a welcomed addition by the IRS as it answers the request of the nation’s tax professional community, Internal Revenue Service Advisory Council (IRSAC), and Electronic Tax Administration Advisory Committee (ETAAC).