Executive Summary

The Fairfax County BPOL tax is a local business license tax based on gross receipts, not profit. Many business owners are surprised to learn that BPOL can apply even if their clients are outside Virginia, especially for consultants, contractors, and remote-first businesses operating in Fairfax County.

- BPOL is a local business tax based on gross receipts, not profit.

- Fairfax County generally taxes where the work is performed, not where customers are located.

- If your business operates in multiple jurisdictions (remote work, contractors, multiple offices), receipts may need to be apportioned.

- BPOL is generally constitutional when applied correctly under standards courts use for state and local taxes.

- The biggest risks are misclassification, missed filings, and poor documentation—not out-of-state customers.

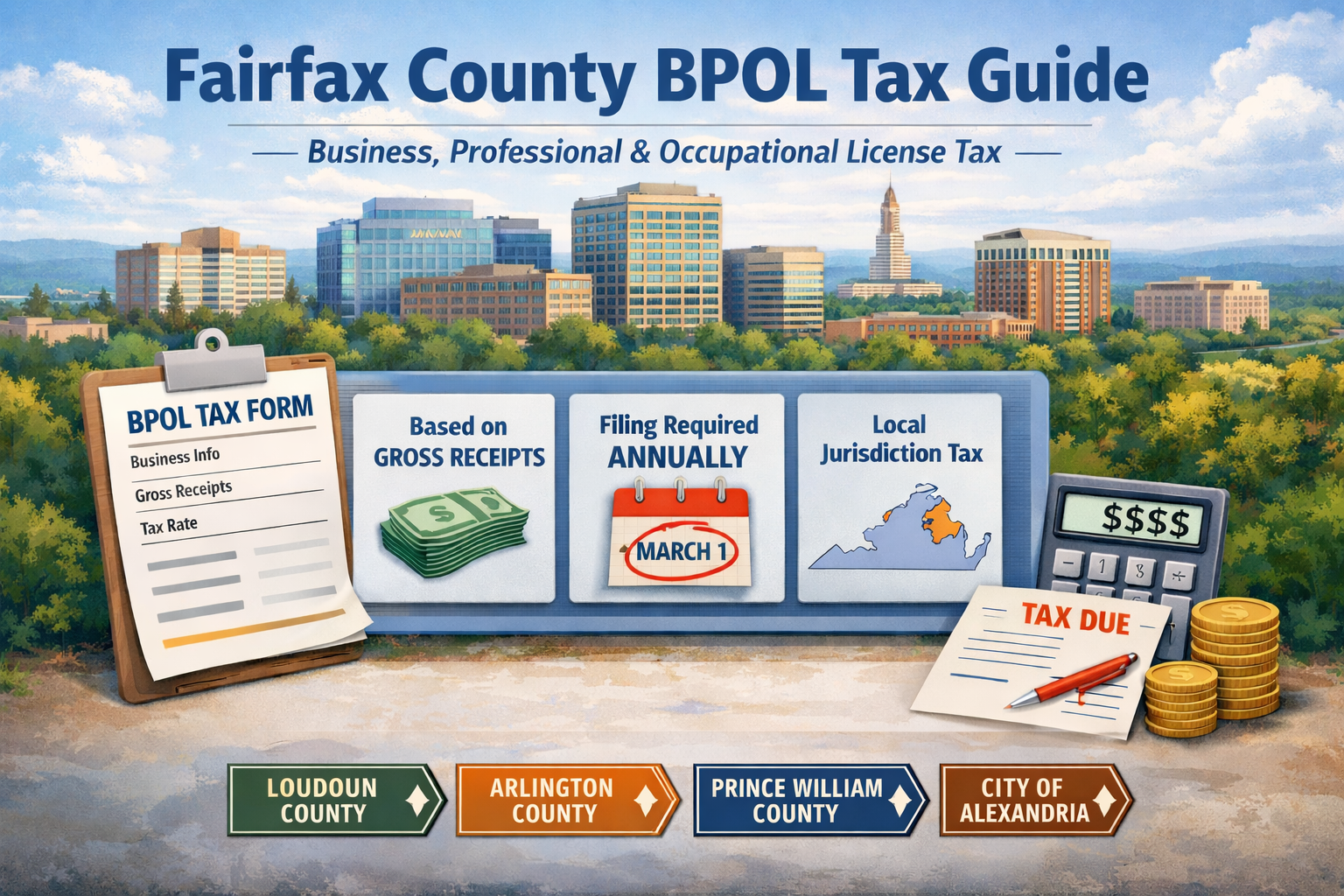

What Is the Fairfax County BPOL Tax?

The Business, Professional, and Occupational License (BPOL) tax is a local tax Fairfax County may impose on businesses operating in the county. Unlike income tax, BPOL is calculated using gross receipts (or gross purchases for wholesalers) and is administered locally, not by the state or IRS.

Official Fairfax County resources

- Understanding BPOL: https://www.fairfaxcounty.gov/taxes/business/understanding-bpol-tax

- BPOL rate schedule: https://www.fairfaxcounty.gov/taxes/business/bpol-license-rates

Who Must File BPOL in Fairfax County?

You generally must file a BPOL return if you have business activity in Fairfax County, such as:

- An office or home office used for business

- Employees or contractors performing services in the county

- Regular business operations conducted from a Fairfax County location

Important: Filing may be required even if no tax is ultimately due.

Fairfax County BPOL Rates by Business Category

Fairfax County applies different BPOL rates based on business classification. Rates are applied per $100 of gross receipts (or purchases for wholesalers).

| Business Category | Fairfax County BPOL Rate |

|---|---|

| Professional Services (CPAs, attorneys, consultants, engineers) | $0.31 |

| Business Services (IT services, marketing, admin services) | $0.19 |

| Contractors (construction, trades) | $0.11 |

| Retail Merchants | $0.17 |

| Wholesale Merchants (taxed on purchases) | $0.04 |

| Repair Services | $0.19 |

| Personal Services | $0.19 |

| Rental Property Businesses | $0.26 |

Tip: Classification often matters more than the rate itself. Misclassification is a common and costly mistake.

BPOL Rate Comparison: Fairfax County vs. Nearby Jurisdictions

If your business operates across Northern Virginia, rate differences—and sourcing rules—matter.

| Jurisdiction | Professional Services | Business Services | Contractors | Retail | Wholesale |

|---|---|---|---|---|---|

| Fairfax County | $0.31 | $0.19 | $0.11 | $0.17 | $0.04 |

| Arlington County | ~$0.58 | ~$0.35 | ~$0.16 | ~$0.20 | ~$0.05 |

| City of Alexandria | ~$0.36 | ~$0.35 | ~$0.16 | ~$0.16 | ~$0.08 |

| City of Falls Church | ~$0.52 | ~$0.36 | ~$0.16 | ~$0.19 | ~$0.08 |

| Loudoun County | ~$0.33 | ~$0.17 | ~$0.13 | ~$0.17 | ~$0.05 |

| Prince William County | ~$0.33 | ~$0.21 | ~$0.13 | ~$0.17 | ~$0.05 |

Official BPOL / business license pages

- Arlington County: https://www.arlingtonva.us/Government/Programs/Taxes/Business-License-and-Taxes

- Loudoun County: https://www.loudoun.gov/1570/Business-Tax-Rates

- City of Alexandria: https://www.alexandriava.gov/taxes/business-license-tax

- City of Falls Church: https://choosefallschurch.org/180/Business-License

- Prince William County: https://www.pwcva.gov/department/tax-administration/business-license/

How Fairfax County Sources BPOL Gross Receipts

Even though BPOL is a gross-receipts tax, Fairfax County generally looks at where business activity occurs—especially where services are performed.

- Customer location, billing address, or where payments are deposited usually does not control BPOL by itself.

- For service businesses, the key question is often: Where did the work happen?

This approach helps ensure the county taxes only revenue connected to local activity.

Apportionment When Activity Spans Multiple Jurisdictions

If your business performs services in more than one locality, Fairfax County allows apportionment so it taxes only its fair share.

Common methods include:

- Payroll by location

- Hours worked by location

- A reasonable, consistent activity-based method you can document

When to seek help

- You have remote employees or contractors in multiple counties

- Your business has a home office in Fairfax but work is done elsewhere

- Apportionment materially changes your BPOL liability

- You lack documentation supporting your method

Remote Work, Contractors, and Foreign Staff

Independent contractors (1099)

Independent contractors are treated as businesses, so BPOL may apply if services are performed in Fairfax County—even if clients are out of state.

Employees (W-2)

W-2 employees are not subject to BPOL because BPOL applies to business activity, not wages.

Foreign or offshore staff

Work performed entirely outside Fairfax County may support apportionment, provided your documentation reflects where services are actually performed.

Common BPOL Mistakes Fairfax County Businesses Make

- Assuming out-of-state customers mean no BPOL

- Using the wrong business classification

- Failing to apportion receipts when work spans jurisdictions

- Inconsistent or missing documentation

- Missing annual filings even when tax due is minimal

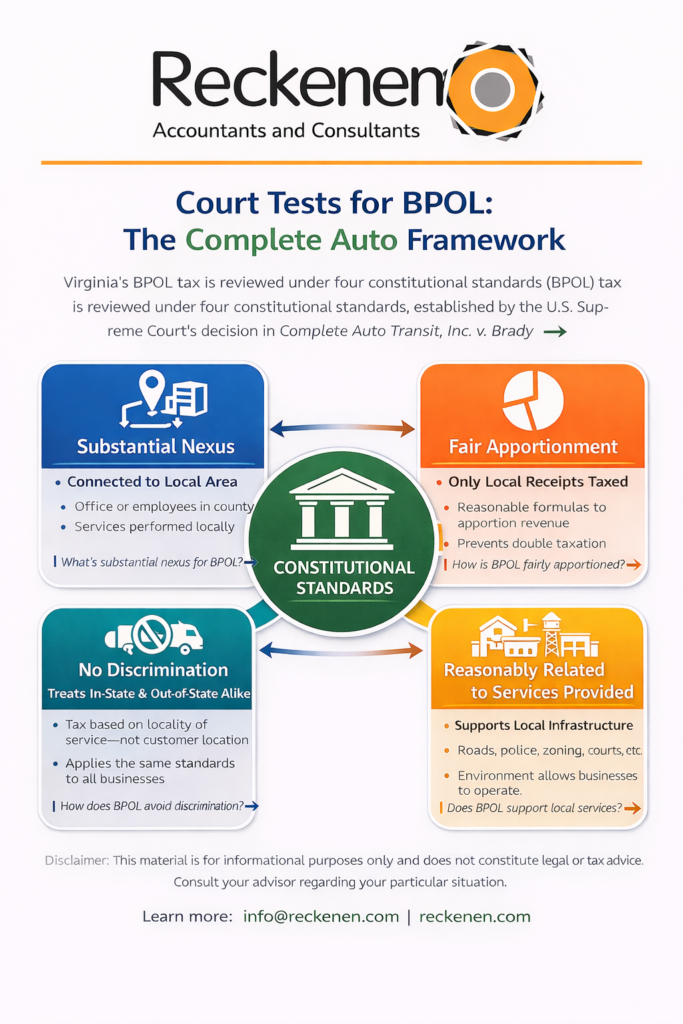

Constitutional FAQ: Why BPOL Is Generally Upheld

Courts evaluate state and local business taxes using standards from Complete Auto Transit, Inc. v. Brady. While not a BPOL case, it provides the framework courts use.

Reference: https://www.law.cornell.edu/supremecourt/text/430/274

The four questions courts ask (in simple terms)

- Nexus: Is there a real connection to Fairfax County?

- Fair apportionment: Is Fairfax taxing only its share?

- No discrimination: Are interstate businesses treated fairly?

- Reasonably related: Does the business benefit from the local environment that supports commerce?

BPOL generally survives review when it is properly sourced and apportioned.

When to Seek Help With BPOL

Consider a review if:

- You operate in Fairfax and another county or city

- Your classification could reasonably fit more than one category

- You have remote teams or contractors

- You received a county notice or audit inquiry

- Your BPOL liability changed significantly year-over-year

How Reckenen Helps

BPOL is simple on the surface and complex in practice. Reckenen helps businesses across Fairfax County and Northern Virginia:

- Confirm the correct BPOL classification

- Design defensible sourcing and apportionment methods

- Improve documentation and consistency

- Coordinate BPOL with broader business tax planning

Learn more:

- Business Solutions: https://reckenen.com/business-solutions/

- Outsourced Accounting: https://reckenen.com/outsourced-accounting/

- Individual Services (for independent contractors): https://reckenen.com/personal-solutions/

- Contact Reckenen: https://reckenen.com/contact/

Disclaimer: This article is for informational purposes only and does not constitute legal or tax advice. BPOL outcomes depend on specific facts and circumstances.