What to Do if Previous Accountants Made Mistakes

Discovering that your accountant made a mistake on your taxes or bookkeeping can be stressful.

Discovering that your accountant made a mistake on your taxes or bookkeeping can be stressful.

Running a business feels exciting until money comes in late and bills stack up. However,

Retirement should be a time to enjoy life, not worry about unexpected taxes. Many retirees

Many people believe that earning more money means losing all tax benefits. However, that belief

Running a small business is exciting, but taxes can quickly eat into profits if not

Investing is one of the smartest ways to grow your wealth, but it comes with

Growing a startup is exciting; however, financial challenges can slow growth quickly. From managing cash

Growing a business feels exciting, but money problems can slow everything down. Therefore, many owners

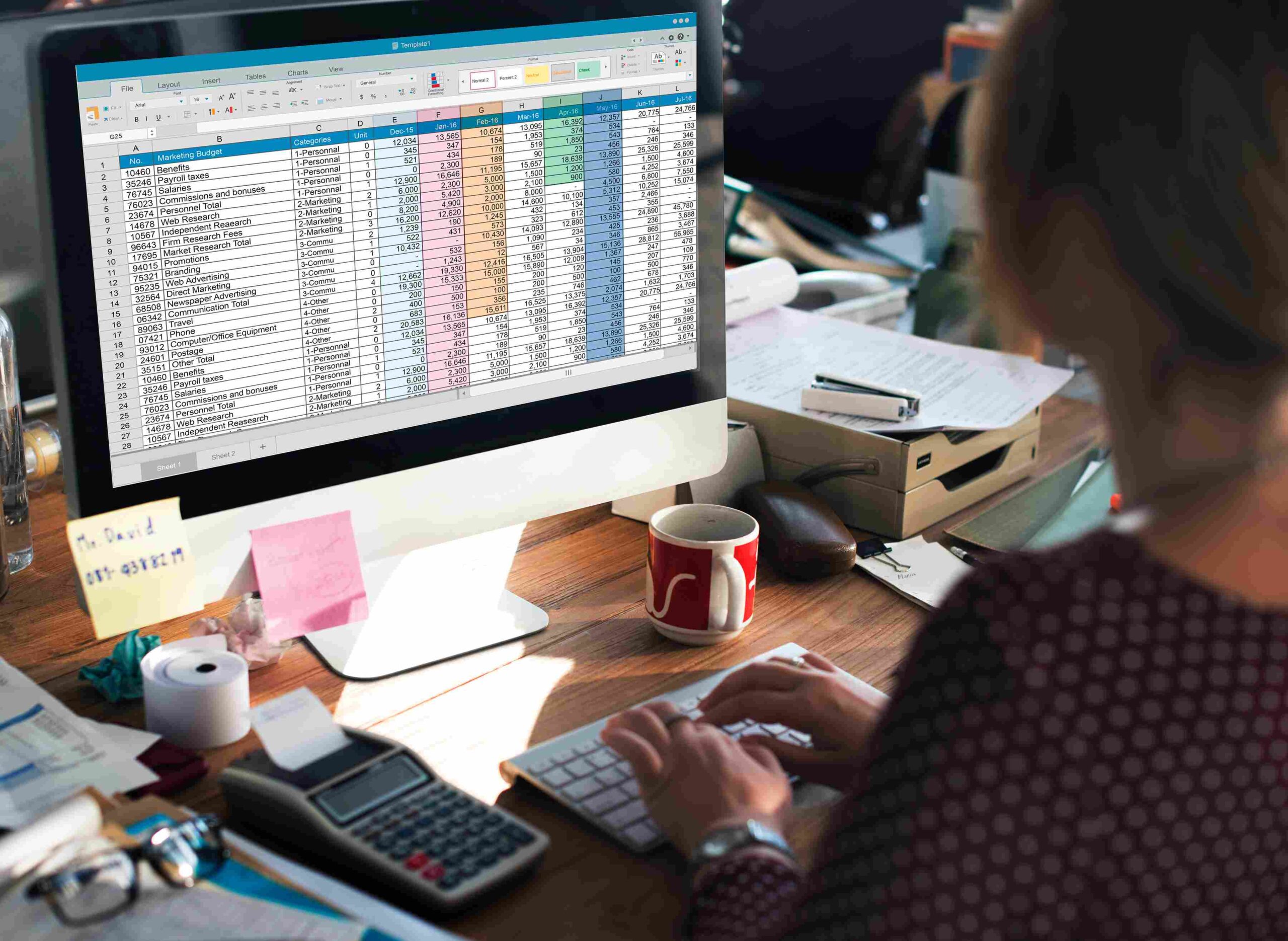

Bookkeeping for small businesses is the process of recording and organizing daily financial transactions. This guide explains what bookkeeping is, why accurate records matter, and how strong bookkeeping supports cash flow, tax compliance, and smarter business decisions.

A Certified Public Accountant (CPA) is one of the most trusted financial professionals for individuals